English

English

English

English

English

English

We initiate the adoption process by evaluating your family values, lifestyle, and philanthropic objectives.

Learn More

Responsible investments should begin with a consistent commitment to being a responsible private firm.

Learn More

The integration of ESGs and collaborations is critical to our effective investment and research processes.

Learn MoreUsing our vision as a firm and a responsible investor, we have created Portfolios with the aim of delivering the same result.

Learn More

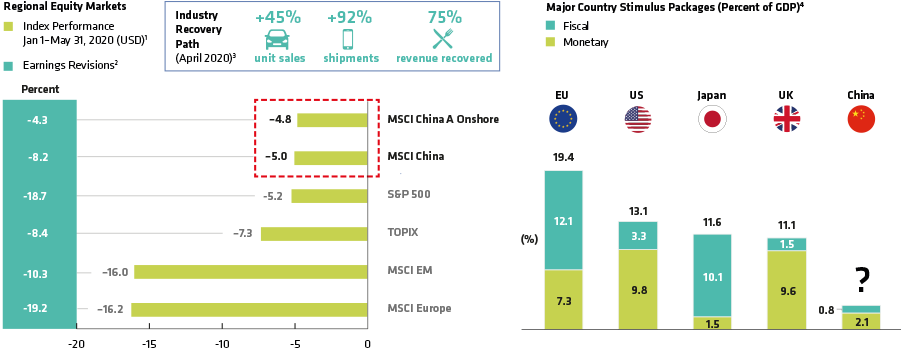

Chinese Equities Benefit From Early Acquisition, Incentive Power

Chinese Equities Benefit From Early Acquisition, Incentive Power

We prioritize our customers' success in every decision, focusing on delivering value, building trust, and adapting to their evolving needs. This customer-centric approach drives our commitment to excellence.

Our extensive suite of cutting-edge proprietary algorithms and layout solutions can be tailored to suit individual requirements. The LC Execution Research team offers guidance, analysis, and strategies to optimize client profitability.

The Luna sales team leverages our extensive private network of institutional clients to generate organic revenue. As a trusted partner, we handle orders with the same meticulous care and diligence as a buy-side trader managing their own transactions. Our High-Touch Trader Team collaborates closely with our Sector Specialists and the aforementioned research team to provide targeted insights that inform trading decisions.

Our experienced international portfolio trading team plays a key role in supporting the planning and implementation of cash flows, estimates, and transitions. They work closely with clients to ensure seamless management and execution. Additionally, our private trading platform enables us to effectively balance the complexities of globalization, providing efficient solutions that cater to the unique needs of our global investments.

The Luna's Equity Derivatives team is working with clients to help improve their performance while minimizing risk. The team provides clients with first-rate exit strategies and use of stock options, ETFs and global indicators.

We have relationships with many accounts around the world, including the world's largest hedge funds and asset management accounts. This network enables us to provide the best revenue and performance for our customers. We specialize in securities issued by financial services companies, Emerging Market banks and specialized conditions, with an emphasis on illegal and subordinate tools.

The team of LunaCapital private portfolio rading strategy provides customers with a personal service to assist our clients with portfolio design, transformation and ongoing risk assessment. The team provides tools for the Luna Cube app which includes risk analysis, portfolio creation and previous trading analysis. Significant market indicators and liquidity events are also analyzed.

We believe in delivering the best for all our people, so we offer leadership development programs tailored to the needs of each party.

We focus on attracting diverse talented people by maintaining a strong employer brand and expanding where and how we meet potential prospective employees. We employ disadvantaged communities, including women, people of color, people with disabilities and people with a military background, among others both in the UK and in the USA.

Our business is designed to help people manage their financial future, and the same applies to our people. We invest in our employees and their future by building a culture of support, teamwork, flexibility and balance.

Learn More

Ongoing development

Ongoing development

Robust benefits

Robust benefits

Modern workspaces

Modern workspaces

Veteran support

Veteran support

Connected… Committed

Connected… Committed

What unites a global investment and research company? Communicating with our customers, our culture, each other and the communities we serve. This unity fosters cooperation and empowers us to pursue a common goal — to bring about better results

New private client solutions from individual investors to major global institutions.

Learn MoreIndependent, in-depth sell-side research and marketing services for institutional investors.

Learn MoreProvide investment strategies, investment planning and risk management services.

Learn MoreWe encourage our people to invest their money and get involved in long-term professional development, so we recoup the cost of authorized business-related education and training. And that’s why we offer informal advice from managers and partners to help people get on-the-job training and support.

We meet the needs of our clients for financial education content content in their communities, such as women and others +, through custom education sessions.

Our user experience team is working to ensure that as the development of LC products and online information is developed, anyone can access it without paying attention to the skills.

We also educate our network of Registered Financial Advisers (RIAs) on the best D&I methods, so that they can maximize progress across the industry.

We feel that the close collaboration between our equity groups and statutory revenue research and portfolio groups gives us a complete view of the issuers.

In order to implement our commitment strategy and measure its progress, we have created a structure that reflects our full commitment to our commitment, from the Accountability Steering Committee to ESG analysts and investors and the infrastructure that supports them.